Is This The Beginning of The Great Tech Depression of 2016?

This post is based on another one of my mildy-drunk tweetstorm rants.

Here’s some news stories that have been making waves in the tech world lately.

-

Silicon Valley’s reality: The party is over — “Money is a little bit tighter from investors and what that tends to do is it means that only the strongest start-ups are able to raise funding,” said Honor CEO and co-founder Seth Sternberg.

-

Stumbling Unicorns — The massive decline in the value of certain public technology stocks will have an impact on private valuations.

I think they represent the general sentiment in the industry. Public markets are in turmoil, and tech stocks are getting hammered. Linkedin market cap was cut in half last week in light of weak guidance. Tableau followed the suit. Yelp was down more than 10% after 4Q2015 earnings. Twitter is breaking it’s all-time low records almost every week.

And it’s not just the public markets. There’s numerous private unicorns (companies valued at over $1B) that cannot justify their inflated valuations in The Real World™. Remember the Theranos fiasco? Where the company made claims that no one, even their customers or regulators could back? It’s most recent valuation was $9 billion. Or that time last when when Foursquare faced The Real World™ and raised a down round?

Here’s a small thought experiment: if today’s unicorns went public next quarter at their current private market valuation, realistically, what market cap will they trade at in a quarter or in a year? The VCs will liquidate and enjoy returns, but eventually it’s the employees that lose. But until there’s a liquidity event, everyone’s a loser.

This is especially bad news for IPO candidates. Only two companies — both biotech, both last week — have gone public since mid-December, the longest IPO drought since September 2011. Tech companies that did go public in the recent past aren’t faring well either. Square is down 36 percent in 2016, Match Group down 32 percent, New Relic down 40 percent and Hortonworks 64 percent.

The bigger point is…

You can only pump so much capital into a business that does not have a stable revenue stream.

Money is not always the solution. In engineering, we have a belief that throwing more machines at the problem doesn’t magically solve it. Or, the fact that nine women can’t have a baby in a month (who said this originally?).

Mattermark

Mattermark

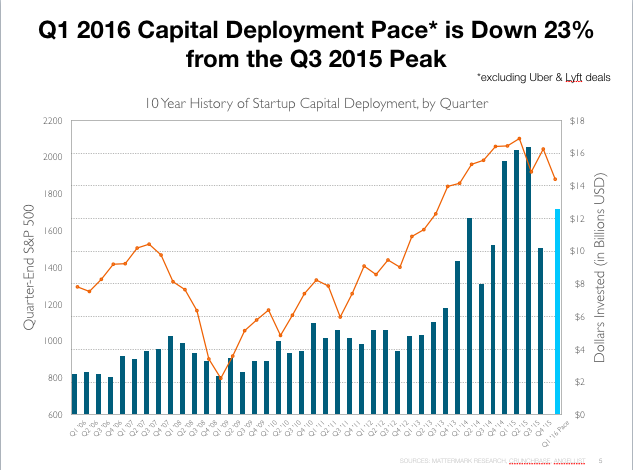

As the chart above shows, capital deployment pace for startups in 2016 is down 23% from the Q3 2015 peak.

VC money is drying up fast thanks to the mega early rounds. A rough Mattermark search shows 107 Series A rounds over $20M each in Q3 and Q4 of 2015. That’s a lot of money. And VCs (and their investors, the LPs) expect healthy returns. With the tech IPO market in its worst state since 9/11, the returns are nowhere to be seen.

It’s clear form the public and the private markets, that investors are fleeing the tech sector after the companies failed to deliver the promised growth or returns.

A lot of the unicorns have raised enough money to survive this downfall. But the whole ecosystem is being dragged down, or at worst remain stagnant. There won’t be new startups, there won’t be new jobs, salaries would (probably) not go up. Even worse, innovation will be hindered.

But, and I truly believe this to be true — we come out with a better outlook. We’ll be practical about valuations and expectations. Maybe the unicorns that survive will get to go public. Maybe, we’ll care about building a business and not just an app.

Existing stock market is in its correction phase, which is needed to check our expectations. Obviously, I’m neither a market analyst nor a behavioral psychologist. But personally, I’m not reacting emotionally to market swings — something I’ve learned from Warren Buffett and Benjamin Graham. I recommend you don’t either.

Having said that, what we have been seeing this year is unusual. Market swings are normal, but the level of changes we’ve seen — oil, China, US stocks corrections — is a different beast. I still don’t know where it will take us, and it’s definitely not going to be a smooth ride.

Like what you read? Please share it with your friends and family. It would mean so much to me.

Image: https://flic.kr/p/GuQXw